The year 2021 will be remembered as a landmark year for India’s start-up ecosystem with USD 38 billion fund-flow. Unleashing of the country’s entrepreneurial zeal catapulted it to become the third largest start-up ecosystem globally, behind USA and China. The tsunami of fund flows shattered all previous records and was over three times the USD 11.1 billion as in 2020.

India’s start-up ecosystem was a key highlight of the Economic Survey 2021-22 too, which highlighted the fact that over 14,000 new start-ups were registered during the year. An annual report card of the economy, the Economic Survey examines performance of a number of sectors and suggests future moves. It also reflects a GDP growth projection for future.

According to Department for Promotion of Industry and Internal Trade, the total number of recognised start-ups reached over 61,400 by the end of the year. It may be thought that the start-up phenomenon may be urban centric, but the latest Economic Survey estimated that 555 districts (of 748) had at least one new start-up in 2021 vis-à-vis 121 districts in 2016-17. This signifies the holistic growth in India’s start-up story over the last five years.

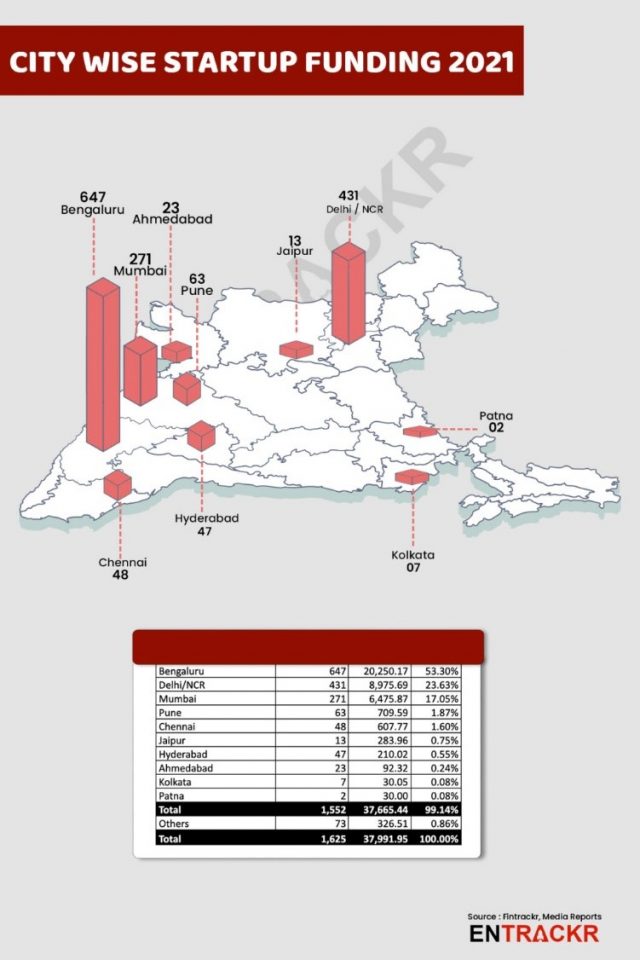

The year witnessed 1625 deals with over 1,391 start-ups accumulating USD 37.98 billion. Although early-stage start-ups grabbed a lion’s share with 948 deals, 380 growth and late-stage start-ups also received funding from various investors. The sanguine growth can also be attributed to government’s focus on ease of doing business as well as an uptick in India’s growth. The coronavirus pandemic may have slowed down the movement in 2020 but a large number of start-ups took advantage of the acceleration of digital adoption in the country in particular.

With over 44 start-ups turning unicorn, India’s overall tally of unicorns are now 83, a significant number them are in the services sector. Well-known names such Share Chat, Cred, Nazara, Grofers, UpGrad, Mamaearth (the first unicorn of 2022), Grofers, and Spinny were among the names that transformed into unicorns.

With some of the new-age companies also getting listed on the bourses, it only demonstrated the transition of into becoming more mature organisations. A total of 11 Indian start-ups (including 8 unicorns) raised about USD 7.16 billion through public offerings. One97 Communication (Paytm) raised India’s largest-ever IPO with an issue size of Rs 18,300 crore (about USD 2.46 billion).

A report by Orion Ventures Partners titled ‘The Indian Tech Unicorn Report 2021′ says that currently one out of 13 global unicorns is born in India. Although Flipkart remains the most valuable unicorn at USD 37.6 billion, Mensa Brands was the fastest to become a unicorn in just six months. The report also accentuates that the country is home to four decacorns (with valuation of USD 10 billion).

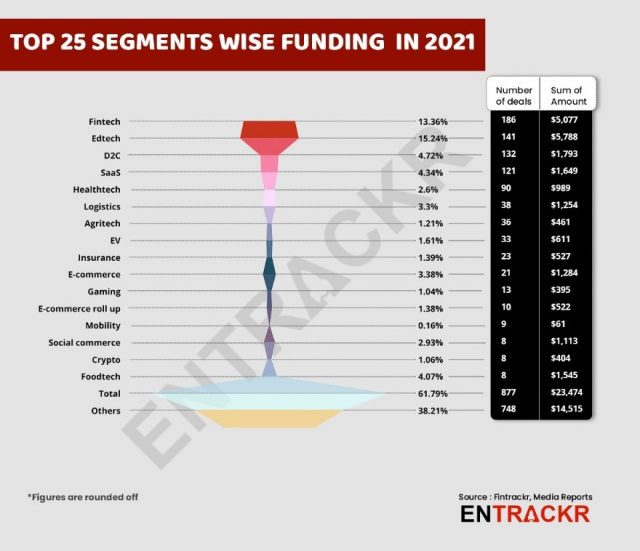

Although EdTech, food technology and FinTech start-ups continued to rule the roost, growth of space tech start-ups was highlighted in the Economic Survey with 47 such emerging companies during the year as compared to just 19 in 2019.

The momentum has continued with over 130 Indian start-ups raising USD 3.5 billion in January 2022 as compared to 75 companies raising just USD 0.6 billion during the same time last year.

Big-Bang Investments

In the first half of the year, EdTech start-up Byju’s was the leader in raising funds of about USD 460 million, eSports start-up Dream11 came in close second by raising over USD 400 million during the same phase. The next quarter saw Udaan (focused on small and medium businesses), food delivery giant Zomato, BharatPe, Zetwerk, boat, and infra.Market raising big funds. Companies such as Digit Insurance, Infra Market, Innovaccer and Five Star achieved the Unicorn status too.

Despite the second wave affecting India badly in the second quarter, 268 start-ups raised over USD 8.6 billion in total funding, indicating the robust and resilient Indian start-up ecosystem. Furniture start-up Urban Company, food-tech company Swiggy, medicine delivery PharmEasy, new-age wardrobe company Meesho, delivery start-up Delhivery, payments company Zeta and fin-tech company CRED were amongst the top 25 funded start-ups. The period also saw 11 companies becoming unicorn. Interestingly, some of the early-stage start-ups such as Mensa Brands, Fam Pay, and Kutumb raised funding during the period even as Mensa Brands went on to become the fastest unicorn just some months later.

It’s Domination Bengaluru

India’s Silicon Valley Bengaluru continued to rule the roost with 647 deals while cities such as Delhi NCR, Mumbai, Pune and Chennai together witnessed over 800 deals. Furthermore, Bengaluru was the numero uno in terms of churning unicorns with 19 out of 43 start-ups turning unicorns in 2021. Some of the notable names include Digit, CRED, Groww, MPL, and Zetwerk. The 43 start-ups that transformed into unicorns in 2021 raised over USD 12.46 billion in total funding. This was 32 per cent higher than the total funding raised previous year, signifying the increased confidence of investors despite the lingering pandemic.

SEGMENTATION OF FUNDING

While fin-tech remained on top in start-up funding with 186 deals raising about USD 5 billion, the total amount of investment raised by EdTech start-ups during the 2021 was higher at USD 5.78 billion spanning over 141 deals. SaaS, D2C and healthtech were amongst the top five funded segments during the year.

Trends

Sharechat became the largest funded start-up amongst the unicorns raising about a billion dollars while other start-ups including Meesha, OfBusiness, Pharm Easy and Eruditas were the other top four funded unicorns raising USD 870 million, 822 million, 700 million and 650 million respectively.

Interestingly, it was observed that the multiple rounds of funding were achieved by over 60 per cent of companies in the same year that included CRED, upGrad, Meesho, Licious, Spinny, BharatPe and GlobalBees.

Ending the Year on a High

Although the first half of the year was a stupendous success, the start-up wave was going to explode further in the third quarter with 408 entities raising USD 12.3 billion, with 13 of them turning unicorns which included BlackBuck, Mindtickle, Eruditus, Vedantu, Droom, and BharatPe. Interestingly, CredAvenue, Heads Up, Upscalio and GlobalBees became the top-funded early-stage start-ups.

The best was yet to come with quarter four witnessing 422 Indian start-ups raising USD 12.93 billion, half a billion higher than the previous quarter. During the quarter, 15 start-ups were crowned the unicorn status too.

Although a significant number of start-ups did not disclose the funding details, the broader trend of start-up funding witnessed in 2021 demonstrates that the Indian start-up ecosystem is growing fast and has tremendous investor confidence, signalling a sanguine journey ahead.