The world of mobility is rapidly transitioning towards electric and lithium is being seen as the magical metal to facilitate the swift change from fossil fuels. This transition is being fuelled both by impending exhaustion of fossil fuels by end of the century and their detrimental impact on environment, leading to one of the most difficult challenges for mankind, Climate Change.

This is why alternative sources of energy are being explored to counter the challenge. The market research company Global Industry Analysts Inc, in its report ‘Battery – Global Market Trajectory & Analytics’, projects the battery market-size at USD 173 billion by 2026. There will be tremendous opportunities for the sector, especially involving lithium-ion. However, developments in sodium-ion technology during the same time may make it a significant contributor to an energy sustainable future. A separate research by Quince Market Insights estimates that the global sodium-ion batteries market in 2021 is about USD 1 billion and this is expected to witness a Compounded Annual Growth Rate of 19.3 per cent between 2021 and 2030

Why Sodium-Ion Technology

Development of sodium-ion battery had commenced in the 1970s but by 1990s, there was clear indication of lithium-ion batteries being more commercially viable. However, factors such as the finite aspect of lithium, safety concerns, probable disruptions to supply chain in future and the high costs have made the world explore alternatives. This is where sodium-ion has been seen as a potential option.

Global Market Intelligence firm, S&P, had estimated that the surge in EV (electric vehicle) sales will increase the global battery demand by five-fold in the next five years. Since electric vehicles need six times more minerals than internal combustion engine cars, EV makers are likely to take up significant share of cobalt, lithium, nickel and other metals needed for making batteries. As per reports, passenger plug-in EVs would account for 68.2 per cent of global lithium demand and 39.3 per cent of cobalt demand by 2025. This may also trigger a shortage of minerals.

A journal paper by authors of Chalmers University, Sweden; Imperial College, London; University of Sheffield, Oxford and Upsala University highlighted that the growing concerns on lithium sources due to limited availability and expected price increase had led to awareness on importance of alternative energy-storage candidates. Additionally, questionable mining practices are driving developments towards sustainable elements such as sodium-ion battery technology in different application scenarios, such as low-cost vehicles and stationary energy storage.

Lithium production is expensive; the element is unstable at high temperatures and is a finite resource. On the other hand, sodium is a common element mined from soda ash and is also omnipresent, such as in seawater, which occupies over 70 per cent of the earth. It is estimated that lithium-ion batteries need cobalt, a metal with limited reserves and production priced at about USD 28,500 per ton.

Faraday Institution had estimated that Sodium is the 7th most abundant element and 1200 time common than lithium, as it is evenly distributed on the earth. This will make it less expensive than producing lithium ion battery. Furthermore, manufacturing of sodium-ion cells can be done with ample metals such as iron and manganese, facilitating large-scale production.

Sodium batteries also perform better at different temperatures (including cold environment) vis-à-vis lithium-ion batteries which are more vulnerable to catching fire. Safety risks connected to sodium-ion batteries are far lower as compared to lithium-ions batteries, which need to be in a partially charged state for avoiding the risk of fire. Additionally, the abundance of sodium, 300 times more than lithium, according to Jefferies Group LLC analysts, ensures that the power packs will cost almost 30 to 50 per cent less than the cheapest electric car battery options available currently.

Richard Seiho Kim of IHS Markit, a global consultancy, had opined that sodium-ion batteries are a better alternative to aluminum or magnesium, making them an ideal option in future. This potential is reflected by the major investments that are being made by industry in a wide variety of markets and in diverse material combinations. Yet, there is a need for more detailed study of chemical and physical processes occurring in the sodium-ion batteries and can result in some groundbreaking advances, from lab-scale to scale-up.

In terms of scope, a report by IDTechEx forecasts the market for non-lithium battery chemistries storage to grow at CAGR of 61 per cent between 2022 and 2032. Furthermore, the stress on sustainable batteries by 2030, highlighted by the World Economic Forum in 2019 to reduce greenhouse gas intensity of battery value chain by 45 per cent, will also play a crucial role in development of sodium-ion battery systems in future.

Lithium Battery Demand

In 2020, just three countries produced almost over 70,000 tonnes of lithium-ion; they included Australia, Chile and China. The International Energy Agency forecasts that demand will surge by a factor of 43 in the next two decades. In the last 12 months, cost of battery-grade lithium carbonate has tripled to above USD 30 per kg, according to the tracking firm S&P Global Platts.

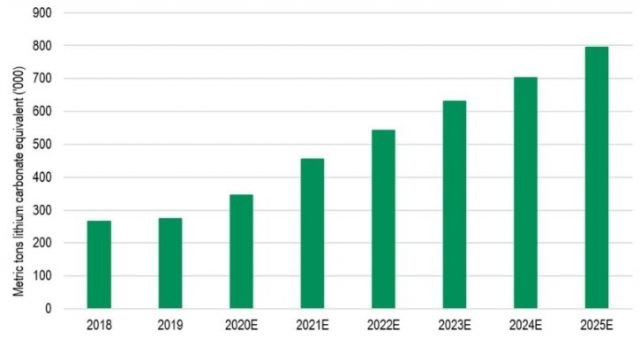

According to S&P Global Market Intelligence, lithium chemical supply will reach 636,000 mt lithium carbonate equivalents in 2022, up from 408,000 mt in 2020 with an estimated 497,000 mt in 2021. The demand for lithium will witness an astronomical rise of 130 per cent in the next five years, especially with the soaring demand for electric vehicles. While over 40 per cent demand came from EVs last year, it is expected to rise to 60 per cent by 2025 while the rest is expected to come from consumer electronics batteries, energy storage batteries and a variety of industrial processes.

Major Players

UK based Faradion Limited: Founded in 2011, has already demonstrated energy densities comparable to commercial Li-ion batteries with good rate of performance. The company also partnered with AMTE Power plc, based in Scotland, which marketed a sodium-ion based battery with advertised storage capacities between 135 – 140 Wh/kg. It is expected to be released by third quarter of 2022.

TIAMAT: Founded in 2017, TIAMAT has spun off from the CNRS/CEA following researches carried out by a task force around the Na-ion technology. With an energy density between 100 Wh/kg to 120 Wh/kg for this format, the technology targets applications in the fast charge and discharge markets.

HiNa Battery Technology Co., Ltd: Established in 2017, it is a spin-off from the Chinese Academy of Sciences, and the company installed a 100 kWh sodium-ion battery power bank in East China

Natron Energy: A spin-off from Stanford University, the company harnesses Prussian blue analogues

Altris AB: A 2017 spin-off company from the Ångström Advanced Battery Centre lead by Prof. Kristina Edström at Uppsala University, Sweden.

CATL: The Chinese company is one of the only ones globally and aims to bring a sodium-ion based battery to market by 2023. Claiming a specific energy density of 160 Wh/kg in the first generation battery, the company is also planning to produce a hybrid battery pack which will include both sodium-ion and lithium-ion cells.

Global Developments

UNITED STATES

The world’s leading economy is witnessing much action in the development of sodium-ion technology.

In 2020, the leading developer and supplier of high-power and low-cost Sodium-Ion batteries, Natron Energy, had announced raising USD 35 million in Series D funding for meeting market demand. Investors such as ABB Technology Ventures, NanoDimension Capital and Volta Energy Technologies had led the round while the existing investors Chevron, Khosla Ventures and Prelude continuing their participation in funding.

The series D investment pushes Natron’s total funding since inception past USD 70 million, and will increase the commercialization of Natron’s sodium-ion battery up to 10 times by 2021.

Las Vegas-based firm Bluetti, specialising in manufacturing portable solar-powered generators, developed the world’s first sodium-ion solar generators recently. Aiming to replace lithium-ion batteries, the sodium-powered stations were unveiled at CES 2022 event in early January 2022. The NA300 sodium-ion generator is being touted as the fastest charging solar generator which can go from 0-80 per cent in just 30 minutes.

At the academic front, researchers at the University of Texas developed a sodium-based battery material, which is stable and can recharge as quickly as traditional lithium-ion battery with a potential for higher energy output than current lithium-ion battery technologies. Recently, a team from Washington State University and Pacific Northwest National Laboratory confirmed one of the best results to date for a sodium-ion battery, with a design holding over 80 per cent of its charge after 1,000 cycles.

CHINA

The globe’s second largest economy is already a leader in the electric vehicle domain. It is rapidly moving towards developing Na-Ion technology and making it commercially scalable by 2023. The country’s leading lithium-ion battery producer, Contemporary Amperex Technology Limited (CATL), admitted that the cost and supply chain safety issues are hitting the firm’s profitability with the churn-out of lithium-ion batteries, thinning its profit margins. China’s Commerce Ministry and China Customs indicated that about 80 per cent of China’s concentrated spodumene (lithium ore) imports in 2020 came from Australia, with whom the country is having rough relations in recent past. CATL president Zeng Yuqun unveiled in July 2021 an ambitious roadmap for developing, trials and commercialization of advanced sodium-ion batteries. Chinese State Council’s National Development and Reform Commission and National Energy Administration in a policy paper on energy storage and battery technologies promulgated large-scale application of sodium-ion batteries. For this, CATL may explore commercially viable models to market sodium-ion products for energy storage for solar and wind electricity and as a possible substitute for lithium-ion batteries for cost-conscious users, starting with electric bicycles and low-speed vehicles. The company has already commenced talks with state-owned China National Salt Industry Group to secure supplies. Scientists from the Chinese Academy of Sciences and Delft University of Technology confirmed on working to expedite research into sodium-ion batteries for competing with Li-ion batteries in November 2020.

INDIA

The largest oil importer globally, India has already announced its ambition to transition towards electric vehicles, renewables and sustainable energy. Unfortunately, the ambitious plan of EVs will be dependent much on imports for lithium. This can be another tricky domain as its immediate neighbour, China, with whom relations have been rocky over the last two years, controls over 80 per cent of worldwide manufacturing of Li-ion batteries. This is why the recent investment by the largest Indian company Reliance Industries to acquire world’s leader in sodium-ion battery technology, Faradion Ltd, for about USD 135 million is being seen as a revolution. With significant interest in several markets, including US, Europe and Australia, Reliance will infuse investment of USD 35 million in Faradionto accelerate commercialization of its products, including batteries for electric vehicles. This will come up in the Reliance Industries’ Gigafactory coming up in Jamnagar, Gujarat.

India, which is also witnessing start-up ecosystems emerge quickly, has also seen several start-ups working in the sodium-ion technology domain. These include new research and technology company, Sentient Labs, based in Pune. Led by technocrat Ravi Pandit, sodium-ion battery costs are estimated to be about half of a lithium-ion battery. The company has been incubated by KPIT Technologies, one of the listed and foremost companies in e-vehicle solution space in India. Roorkee-based Indi Energy and Sodion Energy in Coimbatore are also making real strides in thedevelopment of Sodium-ion technology development.

Europe

The continent is looking at a net zero carbon future by 2050. Sustainability is ingrained in its ambitious new European Green Deal. France based Tiamat Energy is planning to produce sodium battery cells in Europe for hybrid cars and support for solar power and wind turbines. The company already raised Euro 5 million to start production of sodium battery cells in Europe for electric cars. The company is also part of the Steering Committee for Automotive Research and Mobility (CORAM) set up by the French government to support the automotive sector as a key technology. Production of the sodium battery cells will start in 2025 with a ramp-up in manufacturing to reach 6GWh annual production by 2030. In the long term, Tiamat aims to produce its cells in Europe and preferably in France with production capacities either on its own or in partnership.

In October last year, scientists at an Estonia university had suggested that Peat, which is available in plenty, can be harnessed for making sodium-ion batteries cheaply to be used in electric vehicles. Europe, which is aiming to be the second largest manufacturer of Li-ion batteries by 2025, is also likely to explore the Na-ion technologies, as the EU Commission had confirmed on a research and innovation framework programme Horizon Europe to foster R&I innovation in the battery sector for about USD 1 billion.

UNITED KINGDOM

UK based solid-state sodium battery company, LiNa Energy in October 2021 closed USD 4.8 million late seed funding round, alluring both existing and fresh investors. The financing will allow the firm to advance technology and buying new equipment for accelerating commercialization plan.

SOUTHEAST ASIA

The deputy chief of the Department of Primary Industries, Thailand in November 2021 had confirmed on conducting a feasibility study on sodium-ion development to see how it can serve commercial purposes. Experts will examine both the physical and chemical properties of sodium-ion.

JAPAN

Japanese automaker Toyota is also running a trial of a sodium-ion-based powertrain design with a range of up to 1,000 kilometres on a single charge.

Sodium-ion seems to be unfolding the future of electric mobility right away.