Venture capital firms are bullish on the new-age Web 3.0 startups as they view the companies as the growth drivers of the next stage of the internet evolution.

Despite the Ukraine-Russia conflict in the last few months and a meltdown in global markets, the Private Equity-Venture Capital appetite for Web3 has continued to grow in India. More than 28 deals worth USD 890 million were witnessed from Jan-April 2022.

The number is already 60 per cent higher than the USD 500 million investments seen in 2021, with the same number of deals, and over 300 per cent higher than the USD 25 million in 2020 with just five deals. This demonstrates that the confidence of VCs in decentralized online ecosystems including decentralized finance, non-fungible tokens, and blockchain technology is gaining popularity amongst diverse financial institutions.

As per a report by Venture Intelligence, despite the recent dip in sentiments due to the 30 per cent tax on cryptos, April 2022 clocked eight deals worth USD 274 million. Web3 infrastructure and gaming NFT startups have dominated the PE-VC investments in 2022 with Polygon (USD 450 million), Rario (USD 120 million), and FanCraze (USD 100 million) being the top deals.

A report by the global consulting major, Bain Capital said that the emerging technologies including web3 or cryptocurrency-based startups are expected to witness continued investor interest, especially as the Indian government looks at adopting the digital currency.

The National Association of Software Companies (NASSCOM), an Indian non-governmental trade association and advocacy group focusing on the technology industry, had confirmed that the cryptotech industry in India has expanded by over 39 percent in the last five years. Besides blockchain space, the technology and entrepreneurship sectors have also witnessed significant growth with 230 cryptotech startups and 34 Indian companies becoming unicorns in 2021.

Web 3.0 and its Significance

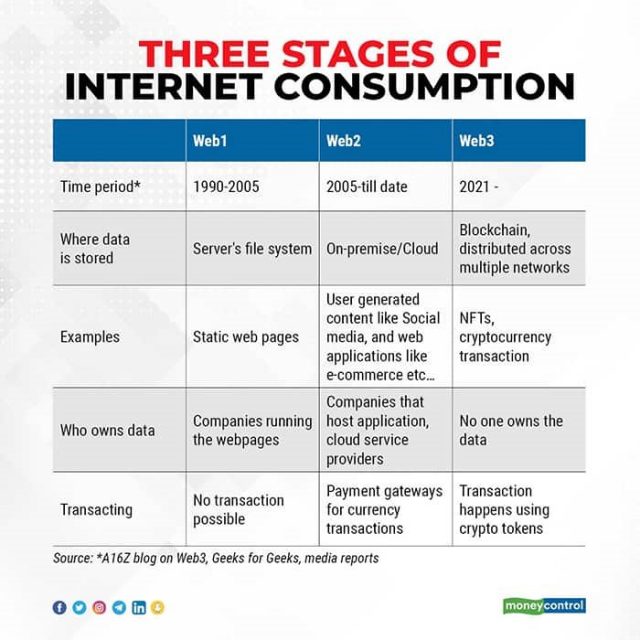

In the last two decades, the World Wide Web has played a vital role in onboarding over 5 billion people on the internet. Although it has been a vital contributor to stable and robust infrastructure, centralized control by select entities has resulted in a number of challenges from concerns of privacy, health issues, and fake news amongst many others.

This is where Web 3.0, being built, operated, and owned by users, embraces the democratization of the internet and is expected to transform the landscape of the internet completely. Currently, the internet is dominated by select technology firms creating monopolies and the possibility of practices benefiting giant corporations. The decentralized technology is expected to help users gain ownership and control of the data, making it difficult to collect data that could be sold to marketers and advertisers. Web 3.0 can also ensure transparency to information access, as blockchains such as Ethereum enable complete encryption. This will disallow both intermediaries to be able to suppress services and websites. Lastly, Web 3.0 is also expected to reduce single point of failure or minimal service disruption, as data would be stored on distributed nodes for transparency and avoiding multiple back-ups.

Created by Gavin Wood in 2014, Ethereum is part of Web 3.0 and has the potential to transform the internet and directly engaging with devices, users as well as systems in smart vehicles, homes, and workplaces. Importantly, Web3 gives ownership of digital assets in an unprecedented way.

Recent India Investments

General Catalyst, which has backed tech firms like Stripe, Snap, and Airbnb, led a USD 25 million round in Web3 startup Stan. This was the first investment in the Web3 and crypto sector in India by the entity. During the same month, early-stage venture capital firm Inventus India had launched its fourth fund seeking to raise USSD 120 milllion, as it aims to deploy the same across multiple sectors including the Web 3 space. California headquartered Lumos Labs raised USD 1.1 million in a seed round for launching the metaverse platform.

Early-stage Indian VC firm Antler India, a part of Singapore-based venture capital platform Antler, has committed on investing in 25-30 startups in the blockchain and Web 3.0 space in the next 2-3 years. During this time, it is aiming to deploy USD 100 million in more than 100 Indian startups, from which half will be committed towards Web 3.0. Another VC Fund, Incrypt Blockchain, has invested in Mudrex, a social trading and decentralised finance aggregator, OnJuno, a payroll infrastructure bridging banking and crypto, among others.

One of the biggest VC in India, Sequoia Capital India made 19 investments in web3 startups just in the second half of 2021. As per the VC, the underlying infrastructure of blockchain is reaching a point to support volume transactions at low costs. Rajan Anandan, Managing Director at Sequoia Capital has reportedly opined that India’s startup ecosystem represents much potential and entrepreneurs can use Web3 for making it big globally.

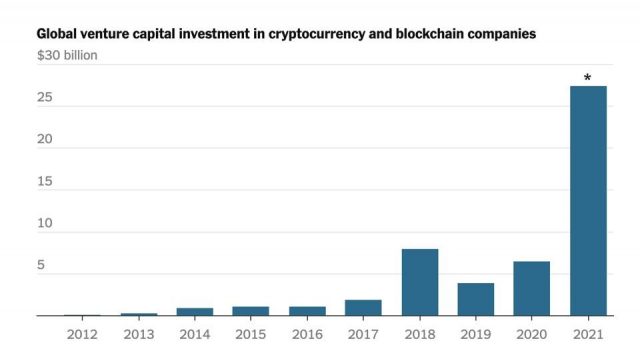

Morgan Stanley confirmed that crypto start-ups received about USD 30 billion from VC funding in 2021, representing 7 per cent of all VC investments globally. However, the American multinational investment management firm said believes the amount of crypto VC funding could slow down significantly by year-end as the period of “easy money is over.”

However, India’s impending cryptocurrency regulation bill is expected to bring much clarity on crypto investments. With the RBI working on a digital version of the fiat currency, it will result in boosting the confidence of digital currency enthusiasts.

Global Developments

It is anticipated that the flow of institutional capital into the Web3 ecosystem will push valuations northward and intensify competition among VC funds. Factors across verticals including stage, geography, and value add will become vital for funds.

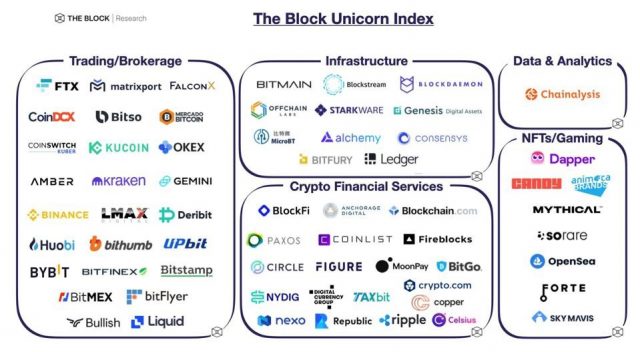

The higher frequency of later-stage rounds led to a minimum of 65 startups in the crypto/ blockchain sector surpassing USD 1 billion valuations, with more than 40 firms attaining the unicorn status last year.

Globally, California-based investment firm Andreessen Horowitz announced two new funds — a massive USD 4.5 billion fund for crypto and block-chain companies and Web3.0 start-ups and a USD 600 million ‘Games Fund One’ exclusively focused on the gaming industry. Some of the former executives from one of the largest cryptocurrency exchanges Binance have also created a USD 100 million venture fund.

In March 2022, US-based Bessemer Venture Partners launched a USD 250-million fund dedicated to the cryptocurrency space as it aims to sharpen its focus on the industry.

Conclusion

The Web3 ecosystem is being seen as a mix of talent (entrepreneurs) and capital (VC). Furthermore, inclusion of new technology allows all major requirements for explosive innovation and growth. Maturing of applications and wider adoption of decentralised technologies will enable mainstream adoption of Web3 applications.