“Data is the new Oil”- Clive Humby, Famous British Mathematician and Data Science Entrepreneur

Back in 2006, when Humby made the above statement, the world had less than 2.5 billion cellphone globally and less than 15 percent of people had any access to the internet. Fifteen years later in 2021, the number of mobile devices has increased to 15 billion and about 60 percent of the population has access to the internet. This indicates an explosion in the growth of the telecommunications industry during this time.

In the same period, the Indian telecommunications industry has also witnessed an incredible growth, resulting in over 1.2 billion mobile phone subscribers as of 2021, 750 million of which are smartphone users. This has also led to astronomical spike in the consumption of data in the country.

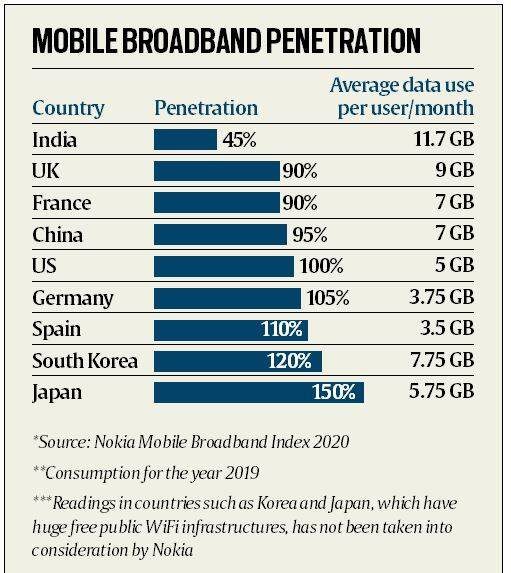

It is estimated that the average mobile data consumption itself has touched 17 gigabytes per month in 2021. The table below reflects the rapidly growing data consumption in the country despite a lower penetration vis-à-vis other countries.

Data Centres Growth

Globally, data centres have been considered a quality real estate asset having been least impacted due to the pandemic, signalling the importance in business continuity.

India’s data centre capacity, currently standing at 870 mw is projected to double by FY25 to 1,700-1,800 mw as a result of rapid digitization, explosive data uptake and upcoming launch of 5G services, as per a CRISIL report.

Data centres are emerging as an attractive infrastructure asset class in India. Furthermore, the doubling of data centre capacity will entail massive investments to the tune of USD 5 billion as vital factors such as data boom, digital adoption and local storage mandates become imminent.

CRISIL anticipates that the growth will be bolstered by optical fibre connectivity, proximity to sub-sea cables, availability of power supply as well as manpower. The data centre Industry in India is at a nascent stage of an unprecedented growth journey.

Factors such as India’s strategic importance in APAC’s digital ecosystem, lower power tariffs, high bandwidth speeds, state-of-the-art infrastructure, and the presence of hyperscalers form the perfect recipe to create and sustain India’s growth as a data centre hub.

Another report by Arizton Advisory and Services estimates that the Indian Data Centres market size (revenue) will be USD 10.09 billion by 2027, witnessing a CAGR of 15,07 per cent (2022-27).

Government initiatives such as Digital India, are likely to augment the growth further as the country aims to become a leading digital knowledge economy. Furthermore, the government is also increasingly becoming more reliant on Data Centres for the Government-to-Citizen delivery platforms like National e-Governance Plan, e-visa, among others. Lastly, the launch of 5G, expected to be rolled out by the end of 2022, will push the adoption of IoT-enabled products in the Indian market.

Arizton estimates that over 2 million sq. ft will be the size taken on by data centres with a power capacity of 350 MW. Arizton also views Data Centre Interconnect or DCI (a phenomenon connecting two or more data centers together over short, medium, or long distances using high-speed packet-optical connectivity) as an important part of the growth trajectory for data centres.

India vis-à-vis the World

The Indian market, though growing rapidly, still had just 130 data centres until February 2021. This is paltry as compared to 2,653 in the USA, 451 in the United Kingdom, 442 in Germany and 199 in Japan. The country’s Data Centre market at USD 7 billion in 2020 was just 3.5 per cent of the global market size of US USD 200 billion and 12.7 per cent of the APAC, as per the Gartner, IDC & Cyber Media Research.

Fourth Industrial Data Revolution

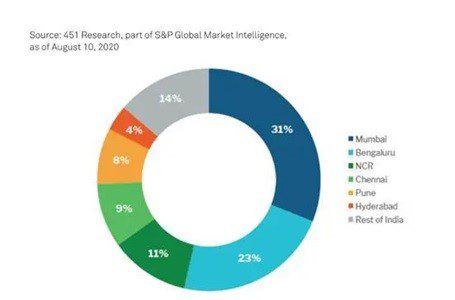

Leading global property agents, Savills India in its report ‘Poised for Growth: Data Centres in India’ states that Data Centre space is likely to increase by about 15-18 million sq. ft across major cities in the next half a decade. The report adds on that as per consulting major McKinsey, India is the second fastest-growing digital economy and the Communications and IT sector will double in the next three years contributing to USD 355-435 billion to GDP.

As per Savills, fast-growing and high-demand sectors such as Internet of Things, Artificial Intelligence and Cloud are expected to drive a huge chunk of the demand for data centres. Infact, the Cloud Computing market will almost triple to about USD 15 billion, from merely USD 5 billion in 2020.

Private Sector- Tapping Massive Growth Opportunities

In a recent report by the ratings agency ICRA, Indian data centres capacity expansion is likely to witness a five-fold increase with expected investments worth USD 12 billion-15 billion in the next five years. The agency identified hyper-scalers like Amazon Web Services, Microsoft, IBM, Meta, and Google outsourcing their storage needs to third party data centre providers. ICRA said that the operating margins are likely to improve and remain in the range of 40 per cent.

Increasing use of smart devices and corporates embracing advanced technologies led to a massive spurt in data and cloud usage (wireless mobile data traffic grew 31 per cent to 253 exabytes2 in 2021), creating huge demand for data centres.

Increasing customer demand for cloud-as-a-platform is also driving digital transformation in India. According to IDC Microsoft data centre regions in India alone contributed USD 9.5 billions revenue to the economy between 2016 and 2020.The IDC report estimated that, beyond GDP impact, 1.5 million jobs were generated in five years, including 169,000 new skilled IT jobs. The company already has three data centers in Pune, Chennai, and Mumbai before announcing a new one in Hyderabad.

Incidentally, search engine giant Google in 2021 has unveiled its second data centre cluster for India in the Delhi NCR region.

India’s infrastructure major Adani Group too has announced aggressive expansion on setting up data centres in Delhi NCR, Mumbai, Chennai, and Hyderabad, as per the corporate website.

Co-Location or Managed Services

A report by the global commercial real estate services company, Jones Lang LaSalle, the industry’s capacity could cross the 1 GW mark by 2023, twice of the 2021 level. The report further stated that enterprises were rapidly digitising and scaling up the IT infrastructure resulting in robust demand for colocation centres and cloud facilities offering scalability, security, and connectivity at lower costs. It adds that digital transformation will create an economic value of USD 1 trillion by 2025. Data Centres will be the key to drive this wave. As per ICRA, co-location services may account for over 60 per cent of the revenues as compared to less than 30 per cent for managed services. This is because co-location services have higher operating margins due to shared resources compared to managed services clients.

Future Data Centres- Powered by Renewables

Energy is a vital part of the envisaged investments, as it would comprise one-third of the acquired land, one-fifth for substations and the balance for civil works and equipment purchase.

With the world increasingly moving towards green energy, it is expected that capital expenditure will be incurred on the captive renewable energy sources. This will be imperative considering electricity account for 45-50 per cent of the operating costs of data centres. It is anticipated that share of renewables in data centre power consumption is likely to be more than double from the current levels of 15 per cent. Though the data centres may incur a capex, it is expected to result in saving power and sustaining the project’s returns in the long run.

Data Protection Bill- A Boost to Data Storage

The Personal Data Bill of 2021 was a significant step as it offers both the government and organisations with instructions and best practices on the personal information. Data localisation is one of the critical components of the bill and this is expected to significantly lead to an upsurge in the storage capabilities of the country. A host of countries including Russia, the USA, China, Australia, Indonesia, and the EU bloc already have a number of localisation clauses. Higher costs to the tune of 30-60 per cent for businesses are the reasons for some resistance to the data localisation.

Conclusion

Although the finer details of the Data Protection Bill 2021 as well as large-scale adoption of 5G services are awaited, it can provide a greater fillip to demand for data centres in India. However, the country will also need to devise stringent and actionable plans to counter the various risks including cybersecurity, social engineering, and data-theft to make the data centres growth a holistic success.