The growth of Indian e-commerce is being fuelled by price-conscious consumers from the country’s smaller cities and towns. In April 2022, the Government of India had announced the launch of Open Network for Digital Commerce initiative. This aims to “democratise” the country’s rapidly growing digital e-commerce space, which is currently dominated by the US giants Walmart and Amazon in the country, accounting for over 60 per cent of the market share. The objective is to provide local digital commerce stores across industries to be discovered and engaged by any network-enabled applications.

In its pilot stage, the scheme has been deployed in five cities including Bengaluru, Delhi NCR, Bhopal, Shillong, and Coimbatore with over 150 retailers. By July 2022, ONDC had expanded to Noida, Faridabad, Lucknow, Bijnor, Bhopal, Chhindwara, Kolkata, Pune, Chennai, Kannur, Thrissur, Udipi, Kanchipura, Pollachi, Mannar and Ramnathpuram.

Background of ONDC

The concept of ONDC was cultivated by the Department for Promotion of Industry and Internal Trade at the Quality Council of India. Designed and accelerated by a nine-member advisory council, one of the key objectives of ONDC was to give a fair chance to all retailers and SMEs for regaining profit and business potential. The nine-member panel included Infosys Co-founder and Chairman Nandan Nilekani, National Health Authority CEO R. S. Sharma, QCI Chairman Adil Zainulbhai, National Payments Corporation of India CEO Dilip Asbe, among others.

Market Size

As per the Indian government, the ecommerce market in the country was over USD 55 billion in gross merchandise value in 2021. It is expected to jump several notches to reach USD 350 billion by end of the decade. The ONDC programme is targeting 30 million sellers and 10 million merchants online, and is expected to cover about 100 cities and towns by August 2022.

In the near term, ONDC is aiming to raise the ecommerce penetration to about 25 per cent of the country’s consumer purchases, just in the next two years, from about 8 per cent now. The platform is targeting 900 million buyers and about 1.2 million sellers on the network in the next five years. During this time, it hopes to achieve gross merchandise value of USD 48 billion.

As per a report by RedSeer, a strategy consulting firm, the number of online buyers from tier-2 as well as smaller cities, accounting for 80 percent of population, will triple in the next five years. The population is expected to reach 256 million by 2026 from just 78 million in 2021. The country’s rapidly growing ecommerce market will provide a USD 400 billion opportunity by 2030. Globally, the two largest economies, China and the US have a market share of 24 and 20 per cent respectively.

Partners

As per reports, Internet giant Google is already having conversation with the Indian government to integrate its shopping services with ONDC. Another ecommerce player Snapdeal also signed the onboarding agreement earlier in the month. ONDC also had an agri-focused entity in National Bank for Agriculture and Rural Development as one of the key shareholders helping solve technical challenges in the agri sector. This also aims to establish market linkages for enabled players with market ready Farmer Producer Organisations. More than 400 entities have registered, from which 250 are agri-tech startups while 150 are non-agri tech startups.

Further, food tech startups such as Zomato, Swiggy and ride-sharing company OLA are likely to join the ONDC. Furthermore, large conglomerates such as Tata Group, Reliance Industries are also in talks for joining ONDC.

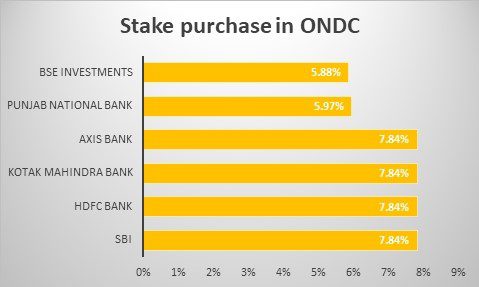

Financial institutions such as Punjab National Bank, ICICI Bank, State Bank of India, Kotak Mahindra Bank, Axis and HDFC Bank have invested in the ambitious digital commerce platform, picking up about 45 per cent of the stake in ONDC. The investment by bigwigs of financial industry demonstrates the confidence in the new initiative and the long-term vision. ONDC had raised major part of the capital requirement for phase one of the operation. ONDC has also managed to raise about Rs 195 crore from institutions such as National Payments Corporation of India, National Securities Depository Limited and Bank of India amongst others.

Advantages of ONDC

Global ecommerce giants have been accused of limiting opportunities through preferential treatment-limiting opportunities for smaller sellers. The ecommerce market functions on two models: the marketplace model and the inventory model. While the marketplace model only has a company working as platform, an inventory model enables a firm to buy the products extremely cheap and sell at higher prices. Hence, commerce firms also monopolise the positions in the market, further limiting the growth of any micro or small businesses and brick-and-mortar stores.

The government expects that ONDC will foster innovation and lead to higher competition. Furthermore, more logistics firms can collaborate with sellers for delivering products to customers, with smaller merchants and rural consumers using Indian languages. Users will be able to view the ratings of different platforms on ONDC itself. It is anticipated that the ONDC model will make deep discounting of e-commerce less potent, as they are engaged in “predatory pricing, especially in high-margin, high-value products”.

ONDC is aiming at digitising and democratising the e-commerce platform as it will completely digitise process of goods and services. It can also empower and encourage suppliers and consumers, which can in turn potentially transform and ensure innovation in sectors like travel, food, hotel etc. Buyers using ONDC-enabled platform will be able to view diverse products from different sellers on a single platform. It is also said that both farmers and farmer producer organisations will get benefit through the UPI-type protocol as it will enable access to a larger market.

ONDC is being seen as a panacea for services and products between buyers and sellers, spanning industries like wholesale, distribution, and food delivery. ONDC can thus standardise operations such as inventory management, order management as well as order fulfilment – facilitating small businesses to do business. Since it will be operating as per the guidelines set under the draft Consumer Protection, 2020, it will provide a filter mechanism on the website on country of origin, display notification on origin of goods and display suggestions of alternatives.

The country has about 1.2 crore Kirana stores, accounting for about 80 per cent of the retail sector. With 4.25 crore Micro, Small and Medium Enterprises, which aren’t digitally enabled, ONDC can enable them to establish a digital presence, expand their customer base and be on a level playing field as other e-commerce giants.

Challenges

The game-changer scheme may fall short of its ambitious goal unless small businesses access and deploy the necessary technological expertise. As per the Confederation of All India Traders, a group representing 80 million businesses, an awareness campaign may be required to bring the small players onboard. Additionally, the smaller businesses may struggle against the discounts offered by bigwigs such as Flipkart and Amazon.

Another challenge is that the country lacks an established set of regulations for ecommerce consumer liability. Furthermore, online players such as Amazon and Flipkart have a well-developed customer service while the volume of grievances on ONDC may not be easily serviced due to a limited bandwidth. As per a report by equity firm Jefferies, ONDC may not be UPI for online ecommerce in the country.

Logistics management is another challenge, as the sector has several challenges including cancellations and returns. It is yet to be seen how the Consumer Protection Act can apply to the players on the platform.

Emulating the UPI feat

The Indian government has been envisaging ONDC to be a private sector-led, non-profit company while fast-tracking its implementation, bringing ethical and responsible behaviour, providing trust, and ensuring norms of governance and transparency.

ONDC is a transaction-centric model and it can emulate the super successful UPI model in e-commerce. Unified Payments Interface, or popularly known as UPI, has been a story of simplifying the mobile banking and digital payments. It is believed that the government is aiming at a revolution in ecommerce akin to how UPI made a disruption in mobile payments industry. ONDC is believed to digitise the entire value chain, promote inclusion of suppliers, standardise operations, and augment value for consumers. ONDC is being compared to UPI as some of the key people spearheading UPI launch are also part of the ONDC’s advisory council. However, the implementation of e-commerce is more complex than a transfer of money as it has additional moving parts.

The government is confident on this ambitious vision as the Union Minister for Commerce and Industry had recently said that ONDC would be gradually expanded to more cities post the success of the pilot phase. Chief Business Officer and President, Shireesh Joshi, had said that Network Expansion for ONDC could create population-scale inclusion of e-commerce in the country.